The Guide On How To Choose Car Insurance

There is a large variety of auto insurance providers in the United States. They offer customers different quotes, terms, and benefits. The process of choosing the right policy might be time consuming and frustrating, so we created this guide to give you a better understanding of how it works.

How to find the most suitable car insurance and not to get lost in a huge variety of offers from different providers? This article will help you make the right decision and save some money.

What Are Car Insurance Quotes?

Every car insurance company offers different quotes. The quotes may vary from state to state, from year to year, and sometimes even from month to month. For the most part, what you pay depends on you and your driving history. First, let's understand what an insurance quote is.

In general, a quote is the amount of money that you are supposed to pay to your company regularly.

These payments are called premiums. The amount of money you pay depends on your personal information that you provide for calculating monthly payments. That’s how two different people get two different quotes.

Every company does calculations in its own way, and you can usually find this information on their websites. There are special websites where you can compare quotes offered by several providers side-by-side and choose which option suits you best.

How Can A Quote Change?

Many people think that once they purchase an insurance policy, the premiums are never going to change. This is not entirely true, because your life may change any time, and new circumstances may affect the insurance cost in unexpected ways. Your quote may change when:

- You get divorced;

- You get married;

- You move to another state or city;

- You buy a car (a used one or a new one).

Tip: Insurance experts recommend comparing your current policy to other offers on the market at least every year. You can find a new insurance provider with more beneficial terms or better customer service.

What Factors Affect the Cost?

One of the main things that determine the amount of your premiums is coverage. The more you want to protect your car, the more you pay. Besides this, there are several factors that affect the final price. Each company evaluates them in its own way, so the cost may vary from provider to provider.

In most cases, the amount of premiums depends on:

- The state where you are going to drive;

- Your credit history;

- Your gender;

- The coverage type you’re willing to get;

- Your age;

- The age of your car;

- Your driving record.

Let’s take a closer look and see why each of these factors is so important.

1. The cost depends on state

All states vary by climate, economy, and other factors. Driving-related risks may be higher in some states compared to the other. For example, if floods or tornados are typical for a state you live in, there is a higher chance that your car may be damaged one day. The same applies to areas with a higher criminal activity.

2. The cost depends on your credit history

Not all companies want to know your credit score, but those who do calculate the amount of premiums taking this rate into account. If you always pay your debts on time and have a good history, you don’t need to worry about it. If you have a sketchy credit history, most likely you will have to pay more. There’s a certain logic behind this: how you pay your debts can speak of how you’re going to pay your premiums.

3. The cost depends on gender

Disclaimer: this has nothing to do with gender inequality. It is based on statistics only. Male drivers usually have to pay more than women. How is this possible? According to statistics, men are more likely to get into a car accident than women, and they’re even more likely to die.

4. The cost depends on coverage type

The more your provider has to compensate, the higher the premiums you pay. You can choose minimum coverage as the least expensive option, or you can purchase a full-coverage policy if you want to invest in your future financial stability.

5. The cost depends on your age

Companies typically set higher prices for people aged 69 and older. Older drivers statistically tend to be at higher risk of being involved in an accident. The same goes for young drivers due to their litеду experience. If you are 25 or younger, you should expect paying higher premiums.

6. The cost depends on the age of your car

At this point, it’s the provider’s policy that determines whether it’s an important factor or not. Some companies believe that older cars do not require replacing expensive parts, so the driver can pay less. Other insurance companies think quite the opposite and offer discounts to the owners of new cars because these drivers take care of their vehicles a lot.

7. The cost depends on your driving record

If you are a reckless driver, be sure to pay higher premiums. You can get better and drive more carefully over the years, but your previous driving record plays a huge role while calculating the premiums, so try to keep it as clean as possible.

So How Much Will I Pay?

Now that we know what the amount of monthly premiums depends on, but what about the actual cost itself? In other words, what average amount of money should you expect to pay for your car insurance?

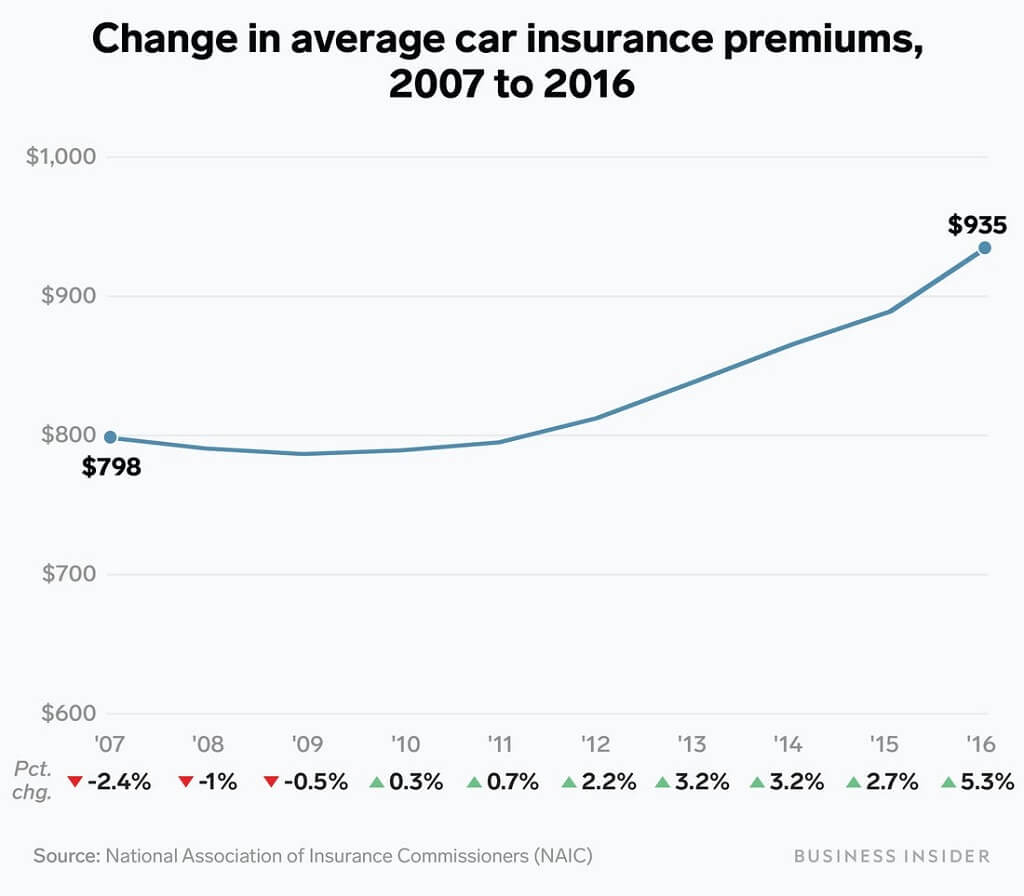

According to insurance experts, the average auto insurance premiums in the USA are $95 per month, or $1,134 per year. Again, it is highly variable, depending on many factors. You can take a look at how the average cost has changed from 2007 to 2016. The rate is growing almost every year, which is predictable.

Average Cost In Different States

Each particular state has its own trends and pricing. Let's take a closer look at the amount of premiums that policyholders pay in every state. You can compare the average numbers below. The states with the highest average annual premiums are ranked first and followed by the states with the lowest ones. You can also see the price of full and minimum coverages.

| Rank | State | Full coverage | Minimum coverage |

|---|---|---|---|

| 1 | Michigan | $3,141 | $1,855 |

| 2 | Louisiana | $2,601 | $771 |

| 3 | Nevada | $2,402 | $717 |

| 4 | Kentucky | $2,368 | $669 |

| 5 | District of Columbia | $2,188 | $839 |

| 6 | Florida | $2,162 | $828 |

| 7 | California | $2,125 | $606 |

| 8 | New York | $2,062 | $867 |

| 9 | Rhode Island | $2,040 | $738 |

| 10 | Connecticut | $2,036 | $891 |

| 11 | New Jersey | $1,993 | $846 |

| 12 | Montana | $1,963 | $447 |

| 13 | Colorado | $1,948 | $553 |

| 14 | Delaware | $1,921 | $843 |

| 15 | Georgia | $1,865 | $684 |

| 16 | Texas | $1,823 | $538 |

| 17 | Maryland | $1,816 | $853 |

| 18 | Oklahoma | $1,815 | $418 |

| 19 | Missouri | $1,798 | $546 |

| 20 | Arizona | $1,783 | $578 |

| 21 | Wyoming | $1,782 | $328 |

| 22 | Arkansas | $1,763 | $449 |

| 23 | Alabama | $1,713 | $498 |

| 24 | Pennsylvania | $1,700 | $502 |

| 25 | Kansas | $1,689 | $464 |

| 26 | Mississippi | $1,684 | $413 |

| 27 | West Virginia | $1,654 | $541 |

| 28 | South Carolina | $1,653 | $617 |

| 29 | South Dakota | $1,643 | $323 |

| 30 | Washington | $1,620 | $537 |

| 31 | Minnesota | $1,619 | $614 |

| 32 | New Mexico | $1,604 | $479 |

| 33 | Hawaii | $1,589 | $485 |

| 34 | North Dakota | $1,577 | $423 |

| 35 | Alaska | $1,560 | $412 |

| 36 | Illinois | $1,538 | $493 |

| 37 | Nebraska | $1,500 | $393 |

| 38 | Oregon | $1,496 | $674 |

| 39 | Tennessee | $1,493 | $462 |

| 40 | Utah | $1,492 | $565 |

| 41 | Massachusetts | $1,466 | $520 |

| 42 | North Carolina | $1,425 | $438 |

| 43 | Vermont | $1,410 | $398 |

| 44 | Iowa | $1,352 | $326 |

| 45 | Wisconsin | $1,335 | $401 |

| 46 | Idaho | $1,285 | $377 |

| 47 | Indiana | $1,266 | $430 |

| 48 | Virginia | $1,196 | $380 |

| 49 | Ohio | $1,191 | $406 |

| 50 | New Hampshire | $1,086 | $424 |

| 51 | Maine | $1,080 | $355 |

As you can see from this rating, drivers in Michigan pay the most, both for full and minimum coverage. The reason is that Michigan drivers get a bigger compensation in case of car damage or a road accident.

Which Insurance Type Do I Need?

When purchasing a policy, you have to decide how much coverage you need. Here are different types of auto insurance, and some of them are mandatory in some states.

Liability Only

This type of coverage is designed to pay only for the expenses of the second party. You are not getting any compensation for any damages or medical treatment. This type of insurance includes:

- Bodily Injury Liability. In case of an incident, your insurance provider pays for all medical expenses of the other party.

- Property Damage Liability. In case of an incident, your insurance provider pays for all expenses related to repairing the second party's car, or the object that you hit.

Uninsured & Underinsured Motorist Coverage

Your provider covers your expenses related to injuries and property damage. However, you get the reimbursement only when you are dealing with another driver who has no coverage at all (uninsured motorist), or their coverage is not enough to compensate for all damage (underinsured motorist).

PIP

PIP (Personal Injury Protection) is designed to pay for any medical treatment that you and your passengers have to receive due to injuries.

Collision

Everything is pretty clear with this type: your company gives you compensation if you crash into any object, e.g. a light pole, a fence, or even another car in a parking lot.

Comprehensive

This type is the opposite of the previous one: it does not imply collisions, but pays other damages to your vehicle. For example, if your car is stolen, smashed, set on fire, and so on. The insurance company’s responsibility is to reimburse all your losses in such cases.

Which Company Is The Best For Me?

Which insurance provider suits you best? Only you can answer this question. We have categorized the most popular US providers so that you can decide which one looks best for you.

A pivot table below shows how the two rating agencies, J.D. Power and A.M. Best, rated various insurance providers.

| Company | J.D. Power Claims Satisfaction Score, 2020 | A.M. Best Rating, 2020 |

|---|---|---|

| New Jersey Manufacturers Insurance Co. | 909 | A+ |

| Amica Mutual | 907 | A+ |

| Auto-Owners Insurance Group | 890 | A++ |

| USAA | 890 | A++ |

| The Hartford | 888 | A+ |

| MetLife | 886 | Not Rated |

| State Farm | 881 | A |

| Erie Insurance | 880 | A+ |

| Allstate | 876 | A+ |

| Nationwide | 876 | A+ |

| Farmers | 872 | A- |

| Esurance | 871 | A+ |

| GEICO | 871 | A++ |

| Safeco | 870 | A |

| Liberty Mutual | 867 | A |

| Auto Club of Southern California | 866 | A- |

| COUNTRY Financial Property Casualty Group | 863 | A+ |

| American Family | 862 | A+ |

| CSAA Insurance Group | 862 | A |

| Travelers | 861 | A++ |

Which Company Is The Best Fit For Teens?

Young drivers are usually considered to be less responsible on a road due to little experience they have. This is the reason why insurance providers set higher prices for people under 25. However, there are some auto insurance companies that offer affordable coverage for young drivers. This is how much their services will cost you per year:

- Allstate ($3.074)

- Nationwide ($3.925)

- State Farm ($3.288)

- Progressive ($3.290)

- GEICO ($3.299)

These insurance providers also offer some good discounts and excellent customer service.

The Most Affordable Insurance For Military

Generally, the military and veterans get better offers in terms of insurance pricing. Here is a list of auto insurance companies that offer affordable policies for the military and veterans, along with great customer service:

- USAA ($883)

- GEICO ($890)

- Esurance ($1.473)

- Farmers ($1.578)

- MetLife ($1.686)

What If I Just Bought A New Car?

If you just bought a new car, congratulations! The first thing you need to do is purchase a policy, of course. In most cases, the amount of the premiums is always higher for new drivers. Here is the average insurance cost per year that some companies offer:

- Nationwide ($2.833)

- USAA ($2.874)

- GEICO ($3.229)

- State Farm ($4.602)

- Liberty Mutual ($4.654)

What Do I Need To Obtain A Policy?

Getting an insurance policy is an important process, but it’s not as hard as it may seem. You can basically manage to do everything in just one day. Here’s how you do it:

- Step 1. Collect all required documents with necessary information. This applies to you and your vehicle. You’ll need to provide your full name, date of birth, and your driver's license number. VIN, model and make are required for your car.

- Step 2. Find out if there’s a type of insurance that is mandatory in your state. Each state has its own requirements.

- Step 3. Figure out what kind of insurance you want to get. In addition to basic coverage, you may be interested in some add-ons. If something happens, the medical treatment and repair services will be much more expensive than your monthly payments.

- Step 4. Calculate how much you’ll have to pay every month.

- Step 5. Choose a plan that suits your needs. Compare different providers, their ratings, reviews, and coverage.

- Step 6. Cancel your old policy if you have one. Make sure not to do it too early – you should not have even one uncovered day. The best solution is to start your new policy and cancel the old one on the same day.

What If I Pay Too Much?

Prices tend to change every year, and you may end up not being happy with the cost of your policy after some time. The best solution here is to find out if there are ways to reduce the amount of money that you pay for your insurance monthly. Here’s what you need to do:

- Compare insurance providers. We already told you how you can benefit from checking quotes regularly, so if you want to potentially save some money, do some research.

- Review your coverage. If you purchased full coverage in the past, think if it is still necessary for you. Some people are happy with only basic coverage that their state requires.

- Choose a plan with a high deductible. The logic here is simple: a higher deductible means lower premiums, and vice versa. If you know you can pay a high deductible, maybe it’s time to change your policy.

- Find out what discounts your company offers. Insurers usually offer discounts for responsible driving, or multiple cars insured at the same time. Some providers lower their prices if their client does not exceed a certain mileage limit per year.

- Drive carefully. If you already have several tickets, at least try not to get new ones. Again, your driving record is very important.