Exotic Animals Insurance

If you want to insure your exotic pet, here is a guide on how to do it smartly.

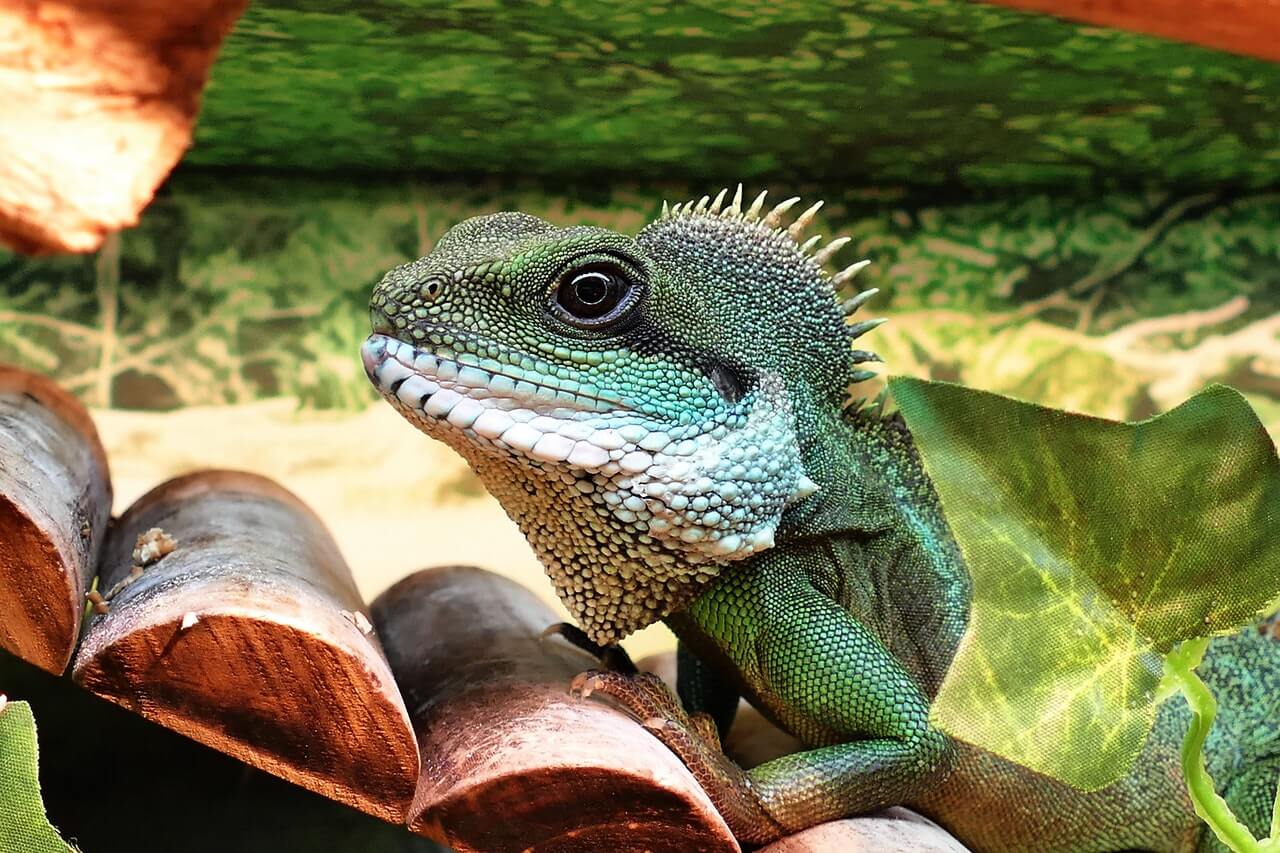

Exotic pets are virtually anything but felines and canines. Lizards, ferrets, teacup pigs – they all fall under the category of exotic animals as surely as they all are vulnerable to diseases, traumas, and incidents. If you bring your cat to a vet clinic for a regular booster shot, it may cost you about $30. But things get much more expensive when you want to vaccinate a non-traditional beast, as exotic animals may require a different treatment and different drugs than mainstream peers.

Still, a loving parent will never want to put their pet’s health at stake because of over-expensive vet costs. That’s why if you have a non-standard animal in your household and want to be sure that his treatment will not break your bank, you should seriously consider buying an exotic pet insurance policy.

How does exotic pet insurance work?

A pet insurance provider will generally offer you to decide between two major options: Accident and Illness (aka Comprehensive or Complete) coverage or an Accident-Only plan.

A comprehensive policy will pay toward any veterinary bills you may encounter while owning an exotic pet, including hospitalization, vaccination, vet check-ups, surgeries, diagnostic procedures, emergency care, prescriptions, and treatment for hereditary conditions.

An Accident-Only insurance scheme will only indemnify costs related to injuries and health complications developed from accidents. Preventive care or check-ups with a veterinarian are generally not covered by such a policy.

Exotic pet insurance works similarly to regular pet insurance, with the only difference that it is all about covering exotic creatures. The term "exotic pets" refers to a wide variety of animals that all share one common thing: they are not cats or dogs. The exotic pet category neither includes farm animals and fish.

How Much Does Exotic Pet Insurance Cost?

You may believe that insuring an exotic critter is much pricier than a conventional doggie or tom, but it is not always true. Insuring an opossum can be as cheap as insuring a cat, though the final quote will depend on the pet’s species, size, life expectancy, care requirements, and many other factors. It means that certain exotic pets may be very expensive to insure, but, as a rule, there are no huge gaps in policy prices for traditional and exotic animals.

When you buy an insurance policy for your unconventional animal buddy, you will have to make a couple of choices, including the size of annual deductible (generally ranges from $100 to $1000), maximum policy allowance (up to $10,000 or above), and reimbursement percentage (usually varies from 70% to 90%).

The bigger deductible you choose the lower premium you will pay.

Your premium charges will be higher if you elect a higher reimbursement level.

Let’s assume you buy an accident-only policy for your ferret with a $500 deductible, 70% reimbursement level, and $10,000 reimbursement cap. You accidentally shut the door on him and break his paw. Now your ferret requires a $1500 treatment. You will pay the entire $1500 to the vet clinic with your own dollars. Then you lodge a compensation claim with your insurance provider. The company will deduct $500 from the claim and indemnify 70% from the remaining $1000. Your final compensation will be $700. However, if treatment expenses exceed your policy allowance limit, it’s up to you to pay the rest.

Pros and Cons of Exotic Pet Insurance

The pet insurance market has been expanding in recent years, with providers being drastically different in terms of price, type of coverage, and reputation. While exotic pet guardians have fewer options, the benefits of the growing market are conveying to exotic pets, as well. Pet owners are free to choose a reimbursement limit, annual deductible, and reimbursement percentage, so that an insurance policy can be easily adjusted for particular life circumstances.

Most pet insurance plans include features such as free yearly checkups and other perks. For example, if you have to take a few days off work because of your pet’s emergency hospitalization, an insurer may compensate you for lost wages.

Just like with your own health insurance, you may have to grapple with certain restrictions when insuring an exotic pet.

Insurance costs can increase depending on your pet’s type. It is known that particular species are more susceptible to illnesses, which may end up with more frequent vet visits and higher medical costs. For instance, domesticated rabbits tend to suffer from overgrown teeth and hairballs (unlike cats, rabbits cannot vomit), while mini-pigs are prone to respiratory and nasal infections.

The age is also a piece of the pet insurance cost puzzle. As your exotic fellow gets older, they may develop health conditions like bad sight or obesity, leading to higher insurance charges. An insurance provider may even reject to insure your pet or decline the existing coverage once your unique buddy reaches a certain age.

Chronic and hereditary conditions may affect the price of exotic pet insurance or even be a foundation for refusing to provide coverage.

Your location and average prices on veterinary services in your area are also factors that determine the cost of your exotic pet insurance.

It's also worth knowing that most insurance companies will set a cap on the amount you can claim to cover veterinary expenses for a single accident or within a given period (exotic pet insurance policies are usually underwritten for one year).

Where to buy an insurance policy for an exotic pet in the USA?

You will not feel like being spoiled by the choice when looking for an exotic pet insurance provider. Nationwide is, perhaps, the biggest and most trusted name in that business as the company sells policies for most small mammals, birds, and amphibians. However, venomous and endangered species are not covered by that dealer.

You can choose among Major Medical, Wellness, and Comprehensive with Wellness types of plans.

For instance, a Comprehensive with Wellness policy will pay for:

- accidents

- surgeries

- hospitalization

- prescription medicines

- medical conditions

- vaccinations

- hereditary conditions (without waiting period)

- routine check-ups

- preventive care

Major Medical coverage is a cheaper plan designed to cover standard medical costs such as accidents and illnesses, surgeries and hospitalization, prescription drugs, and chronic conditions. Some hereditary conditions can also be covered, but only after a 1-year waiting period. A standard annual deductible is $250, ad claims can be submitted by mail, fax, or email.

Alternatively, you can become a member of Pet Assure, a low-cost membership program that offers pet owners a 25% discount on veterinarian visits and medical procedures with virtually no exceptions. Pet owners just need to find a veterinarian in the Pet Assure service area. You can enjoy 25% off on the following procedures for your unusual pet:

- dental care

- diagnostic tests

- spays and neuters

- preventive care and vaccines

- diabetes and cancer management

- hospitalization

- surgical procedures

- wellness and sick visits

- emergency care

- parasite screenings

Once you enroll with the program, you will receive an ID card that guarantees a 25% discount on veterinary services received within the network. There are no deductibles or usage limits. All types of pets are accepted to the program, including farm and exotic animals. Absolutely no exclusions: every medical procedure and service is covered. Pre-existing conditions are not a factor as well. There are also no waiting periods – you can use your discount immediately.

What is the catch?

It is not essentially an insurance policy, but only a 25% discount on healthcare services your exotic pet may require. Moreover, Pet Assure ID cards are not overwhelmingly accepted, and some vets may reject to offer you a discount.

If the above-mentioned options do not suit you, you can contact a local pet insurance provider to find out whether it can offer coverage for your unordinary animal.

Some insurance is always better than no insurance. If your exclusive pet gets sick or injured, going without proper coverage can jeopardize your own savings. The best way to avoid huge veterinarian expenses is obtaining an insurance policy – luckily, it can be as affordable as the one for an ordinary cat or dog.