The Six Best Companies to Provide Your Pet with Insurance

If you are a pet parent, you know that caring for it requires no less effort than, for example, a child. This is why it is so important to protect your furry friend the same as you protect your other family members. For this very reason, we have selected the best companies for pet insurance. Let's unveil their features, strengths and weaknesses, and also find an alternative for those who just want to save money on the treatment of their four-legged friends.

Meet the Best Companies

| A.M. Best Rating | States Available | 24/7 Claims Service | Wellness Coverage | Reimbursement Rate | Deductible | |

| Figo | A- | 50 | Yes | No | 70-100% | $100-750 |

| Petplan | A+ | 50 | No | No | 70-90% | $250-500 |

| Nationwide | A+ | 50 | Yes | Yes | 50-90% | $250-500 |

| Geico | A++ | 50 | No | Yes | 70-90% | $200-1000 |

| Healthy Paws | A+ | 50 | No | No | 60-90% | $100-1000 |

| Pet Assure | N/A | 50 | No | Yes | 25% discount | None |

Figo

Why we chose this company: The company provides new and interesting opportunities for customers through its modern technologies. Moreover, its customer has a good chance of reimbursing expenses and not being rejected by the provider – it pays in 97% of cases.

Pros:

- No penalty after an insured event

- A customer does not need to wait long for the coverage to take effect

- A customer can apply to telemedicine services for his pet

- Reimburses up to 100% of the expenses for treating a pet

Cons:

- Does not provide accident-only coverage

- Does not pay for preventive examinations and pet health services

- Relatively a new company – it operates since 2012

Many companies increase their premiums after claiming, but you do not have to worry about that with Figo – it does not provide a penalty after you were reimbursed for an insured event so your premiums will stay the same. Another company’s unique feature is that its customers who live in the same area can communicate with each other and share events through the company’s services. It also offers its own mobile app where users can talk to veterinarians, get the information they need, be notified of upcoming events, and more.

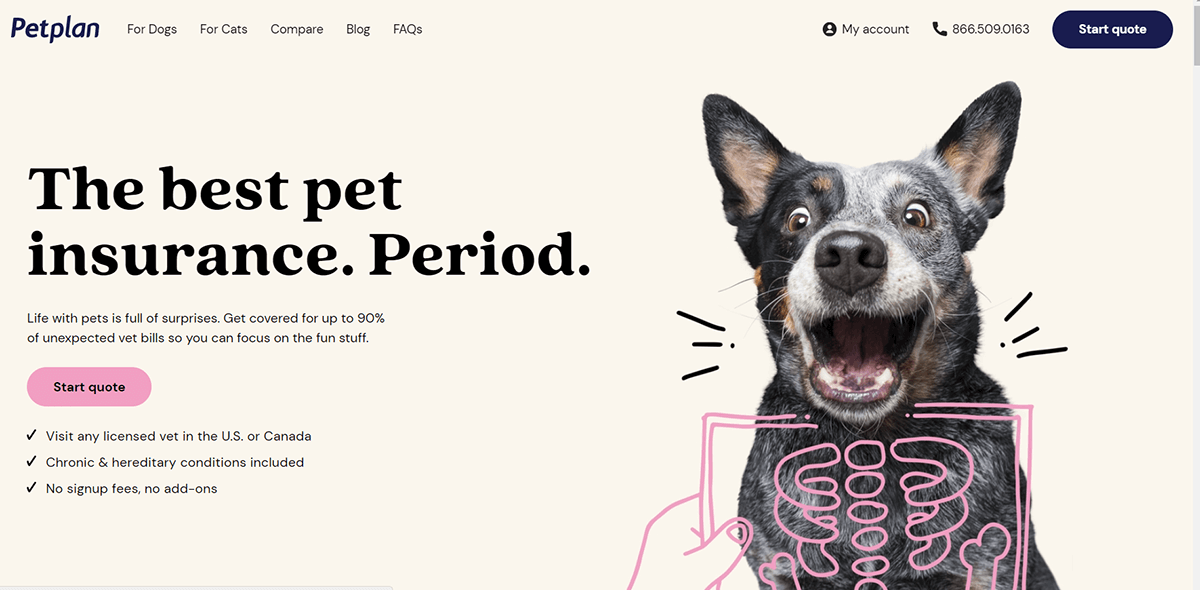

Petplan

Why we chose this company: Its services are relatively inexpensive, but they are worth their price. Although Petplan does not cover the preventive-examination costs, you can protect your pet from all other risks.

Pros:

- A customer does not have to pay copays after an insured event

- No age limits

- Provides convenient and useful online services

- Covers the expenses for finding missing pets

Cons:

- Does not pay for preventive examinations and wellness services

- Does not provide full coverage for older animals

Petplan’s services are available not only in the United States but also in Canada. This provider regularly receives high scores from both rating agencies and its customers. You can purchase an accident-only or illness-only plan as well as a comprehensive one if you want to keep your animal safe from all possible risks. Moreover, the company offers quite flexible policies, that is, you can customize their terms to your advantage. Unlike other providers, Petplan also takes care of older pets: a customer can purchase an accident- or illness-only plan if his pet is more than 10 years old. By the way, the second option is usually not available from other companies.

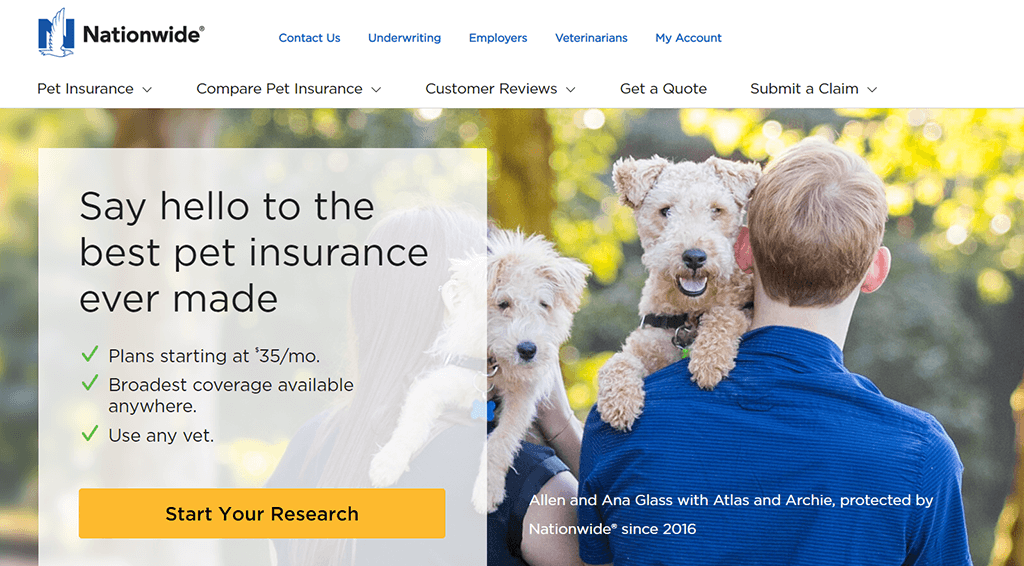

Nationwide

Why we chose this company: Nationwide is a fairly large and reliable company with a long history and vast experience. Its customer can provide his pet with full protection since the company offers all insurance types: accident, illness, as well as preventive and routine examinations. You can find here everything you need.

Pros:

- A customer can purchase coverage for birds and exotic animals

- A lot of discounts, especially for those with multiple pets

- Pays for preventive examinations and wellness services

Cons:

- Quite low reimbursement rate – it starts from 50%

- High service cost

- Does not provide some online services

Nationwide is distinguished by a rather high cost of its services, but the quality and completeness of these services live up to their billing. You can find everything your pet needs among the company’s offers. If you are an owner of any rare animal or bird, Nationwide is one of the few companies that protect such creatures. However, despite the many advantages and a high rate from A.M. Best, many people are dissatisfied with its long claims processing procedure.

Geico

Why we chose this company: First of all, Geico is a trusted company highly rated by A.M. Best. What is more, it boasts competitive pricing and discounts making it quite attractive to those looking for coverage for their pets.

Pros:

- A lot of discounts

- Pays for preventive examinations and wellness services

- A customer can find coverage at any cost

- An ability to customize the coverage for any choice

Cons:

- Does not provide some online services

- Provides services through a third-party company

- No discounts for those with multiple plans from the company

- Older pets can only receive accident-only protection

Geico serves its clients through a third party, namely, Embrace Pet Insurance. Customers can only purchase coverage for cats and dogs so if you have some unique animal, you should contact another organization. Finding a suitable offer is not difficult: when choosing coverage and a plan, you can customize them for your wishes and needs. The customers, who purchase coverage for several pets at once, and also military, will be definitely offered various discounts from Geico. This makes the company quite competitive among others.

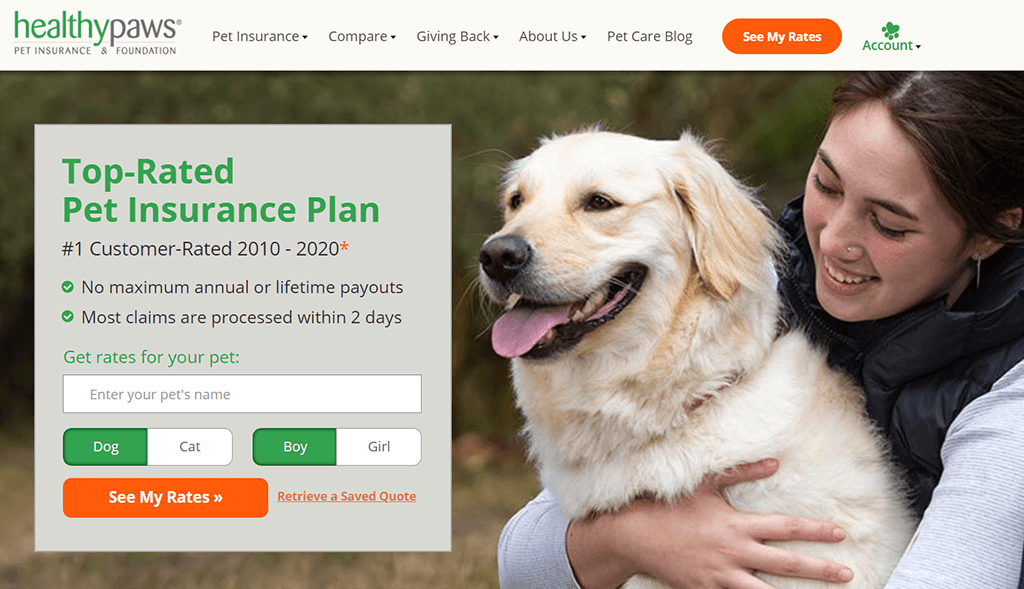

Healthy Paws

Why we chose this company: Healthy Paws offers everything a customer needs: affordable prices for four-legged friend insurance, the ability to use the mobile app services, as well as quick payments in case of illness or injury.

Pros:

- Fast claims processing and payouts

- A customer can immediately know the preliminary service cost as well as compare it with competitors

Cons:

- Does not pay for preventive examinations and wellness services

- Does not provide discounts

- Older animals do not receive full coverage

Nothing is easier than submitting a claim to Healthy Paws. One of the company’s advantages is that you can do whatever you need through their dedicated application, and the waiting period for payments can be only 48 hours! Even though the company is relatively young (it was founded in 2009), this did not hamper it to be one of the best pet insurance providers. Healthy Paws is also actively involved in charity work: throughout its existence, it has repeatedly rescued animals from difficulties and financed various shelters. Customers get policies that are valid throughout the pet's life. This means that you do not need to renew it and pay additional fees for protection prolongation. However, despite all its advantages, the company's ratings are rather ambiguous. Some of its customers complain about premiums being raised without any notification while others chant the praise of it for quick claims processing and high-quality service.

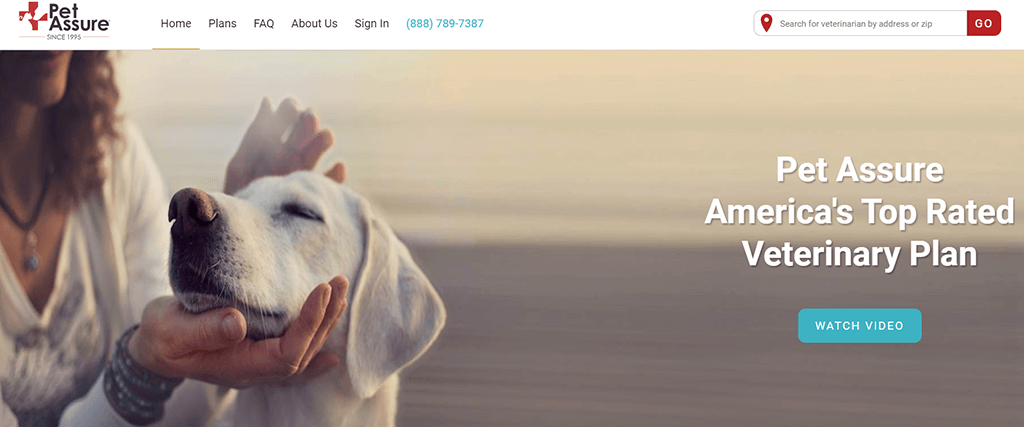

Pet Assure

Why we chose this company: There are fairly low prices for the company’s services, but they are, in fact, not coverage by themselves. Quite high ratings and a clear cost-saving system make Pet Assure a very profitable alternative to conventional coverage providers.

Pros:

- Provides services for owners of any animals

- No deductibles

- Services take effect immediately after purchase

- Provides services even for animals with pre-existing conditions

- A customer gets a discount if he “insures” several pets at once

Cons:

- Does not cover prescription drug costs

- Relatively small number of veterinary hospitals and specialists cooperating with the company

- A very low reimbursement rate

Pet Assure is a great choice for those looking to pay less for veterinarian services, especially if their pets need regular medical attention. The reimbursement process is different here, but, nevertheless, it is quite understandable and attractive. Every time your pet needs a veterinarian, the company gives you a 25-percent discount which means it pays one-fourth of the total service cost for you. Regardless of whom you live with – a cat, a bird, or even a snake – you are guaranteed a discount. You do not need to reach a certain deductible threshold, and there are no requirements for your pet. The company provides services for both old animals and animals with pre-existing conditions.

We have compiled the list of the best companies for you and told you about their main features so that you can provide your furry friend with the best health protection. More and more animals are moving from our backyards to our bedrooms so they are becoming full family members who require the same care as humans. We hope that you and your pet will be satisfied with the company you will choose.